NewSpace impacts the demand for ground segment

Technological advancements such as on-board processing and the introduction of inter-satellite links reduce the need for data downlink to some extent, and thus decrease the demand for ground segment. However, this decrease is being outpaced by an increase in demand due to NewSpace trends. The democratisation of space, with lower barriers to entry, short development cycles and private investment enables innovative, small and agile players to participate.

Traditional deployments of a small number of large and powerful satellites in geostationary orbit (GEO) are now being complemented by large constellations with hundreds or even thousands of small satellites in low-Earth orbit (LEO) to offer low latency broadband connectivity on a global scale. Further driving additional constellations into LEO is the growing appetite for different types of EO data and applications.

A focus on sustainability in space and on Earth has also seen an uptake in satellite missions dedicated to Space Situational Awareness and Space Traffic Management, in-orbit servicing/debris removal, space-based power and other new use cases, all of which result in growing demand for ground segment infrastructure and service provision.

Evolving business models shine light on the future of the segment

As the emergence of NewSpace is fueling growth across the entire industry, traditional business models within the ground segment market are coming up short. Increasing competition and the high cost of ground infrastructure requires companies to remain agile and look for new ways to optimise resources.

A new demand for Ground-Segment-as-a-Service (GSaaS) is emerging, especially driven by EO constellation operators. These constellations typically need a global network of ground infrastructure with relatively low contact time per satellite. GSaaS offers ground station services to legacy and NewSpace operators unwilling or lacking the resources to develop a dedicated ground segment. This model is similar to a “shared economy” approach, with by-the-minute or per-pass pricing. Additionally, subscription or flat rate models comparable to the traditional dedicated antenna model exist.

GSaaS brings new players to the market

GSaaS is experiencing strong market pull from NewSpace operators looking to convert CAPEX into OPEX, especially for LEO applications. By outsourcing the ground segment operating expenditure, satellite operators can lower the upfront investment as well as the inherent risk of commercial failure. Changing requirements can quickly and easily be accommodated, and even complete pivots in technical requirements or business model aren’t hindered by ownership of ground assets. In turn, ground segment providers with expertise and enough customer aggregation can offer a multitude of capabilities and accommodate changing requirements, all while benefiting from the increase in demand for services.

Big Tech companies not traditionally active in the space industry (such as Amazon Web Services and Microsoft) have also entered the ground segment market. This is in part due to the parallels of including an as-a-Service component in their portfolios, and the leveraging of their big Data Centres assets and Data Analytics capabilities. Together with technological developments such as AI for ground segment operations, ground segment virtualisation and flat panel antennas, these new forces may provide a further boost to GSaaS as well as the entirety of the ground segment market.

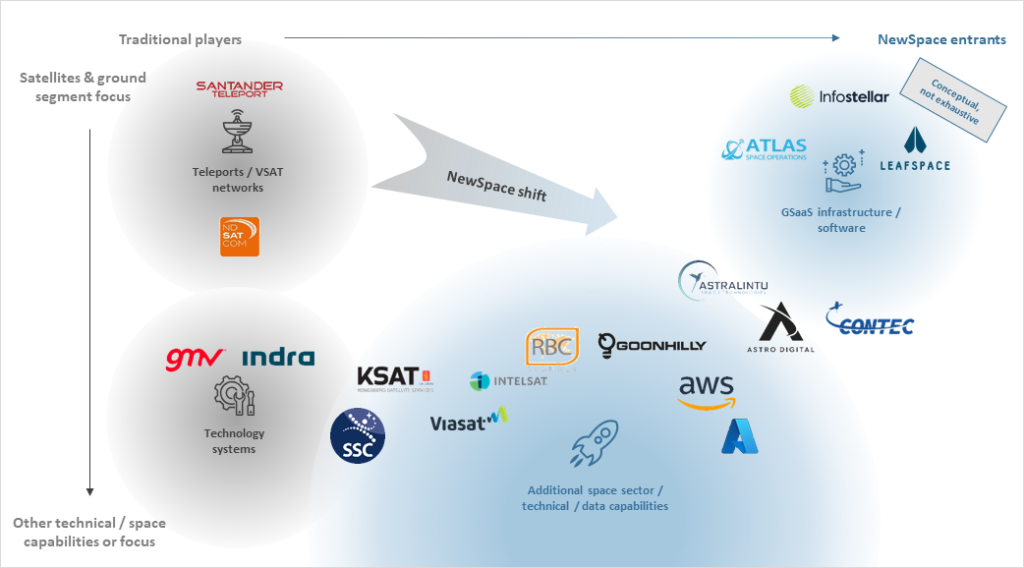

Players in the ground segment and GSaaS market include legacy technology companies, ground station and satellite operators with decades of experience (e.g., GMV, Indra, KSAT, SSC). Agile NewSpace entrants such as Atlas Space Operations, LeafSpace, Infostellar, and Contec, as well as Big Tech companies looking to diversify their cloud offering (e.g., AWS, Microsoft Azure) also play an important role. There might also be opportunities for infrastructure-as-a-service players with technical expertise or facilities in favourable geographic locations. While inevitably some will fail over time, current developments suggest that small NewSpace players as well as legacy operators and big tech all have a place in the market.

A new and improved ground segment offering

GSaaS not only includes the traditional ground segment services such as telemetry, telecommand and control, and uplink/downlink, but also complementary value-adding capabilities such as data centre provision, data analysis, network orchestration, mission design, and consulting. Here are some of the key differentiators when comparing GSaaS to traditional ground segment operations:

- Cost-effectiveness, including the ability to transform satellite operator’s CAPEX into OPEX and the ability to choose a suitable payment scheme (e.g., per minute, per pass, subscription on a monthly/annual basis, reserved or on-demand capacity).

- Flexibility via the on-demand model to serve operators with and without their own ground segment infrastructure, for individual satellites or entire constellations.

- Simplicity via access interfaces and APIs designed for ease of use, e.g., for universities and start-ups.

- Innovation without big investment. GSaaS providers tend to adopt the latest technological developments in the ground segment market (e.g., network virtualisation, network management transition to the cloud, network orchestration, autonomous scheduling).

GSaaS works particularly well for applications that do not have a strong need for real-time data, such as EO data downlink or the Internet of Things (IoT), and with relatively narrow bandwidth requirements. Real-time, high bandwidth applications such as LEO broadband connectivity, and GEO ground segment services might also benefit from GSaaS for emergency use/redundancy. However, they are more likely to implement their own ground infrastructure or take on long-term contracts for dedicated ground segment provision with legacy operators and/or local partners.

Due to the orbital characteristics of associated satellites and the nature of data gathering, GSaaS provision is best implemented via a global network, where a satellite operator can pick a single service provider for their ground segment service needs. In the near future, GSaaS demand is expected to grow thanks to NewSpace developments in general, and an increasing need for both EO and IoT applications (think environmental sustainability and autonomous machines) in particular.

So where does this leave the future of the ground segment market? New business models and operational practices are enabling NewSpace players to disrupt the status quo. Without innovation in these areas, traditional teleports will soon be outpaced. They must look to diversify their revenue streams, explore alternative business models, and keep a finger on the pulse of technological innovation to stay relevant in the market.