Demand for ubiquitous connectivity drives SatCom growth

The main driver for SatCom growth is the demand for ubiquitous connectivity from users. The space economy is expected to reach over $1 trillion by 2040[1], and a large share of this will come from consumer broadband, internet enabled applications and government services, which rely on SatCom to some extent.

Users today don’t care about the actual technical solution; they demand low latency, high bandwidth, and reliable, resilient and secure connectivity. This shift in user expectations alongside technological trends such as Low Earth Orbit (LEO) broadband is increasing the demand for SatCom, including “connecting the unconnected” via broadband direct-to-device (D2D) or seamlessly integrated networks across different satellite orbits, different frequency bands and different technologies (e.g., 5G and satellite).

Multi-orbit integration leverages strengths of each orbit tailored to use case

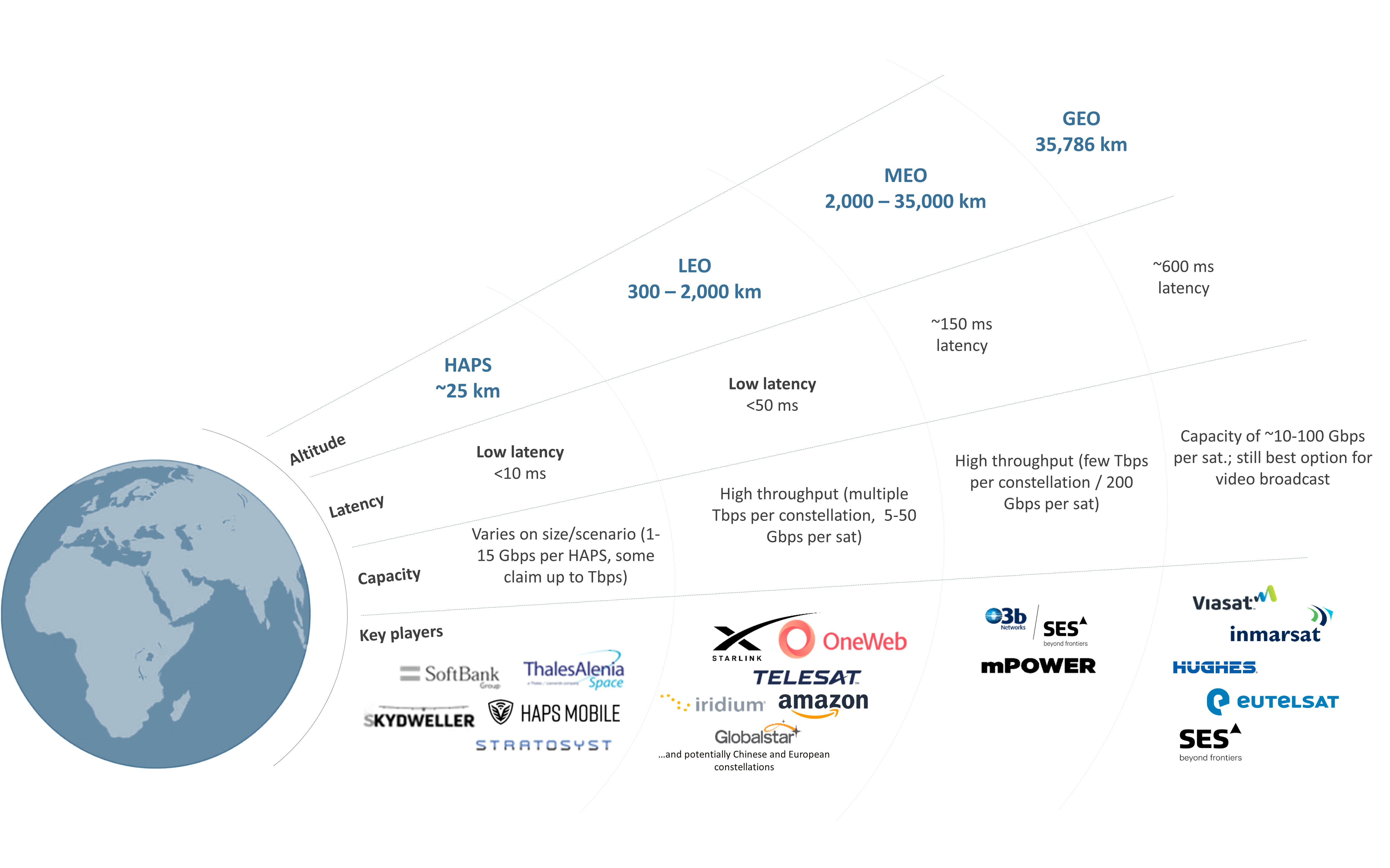

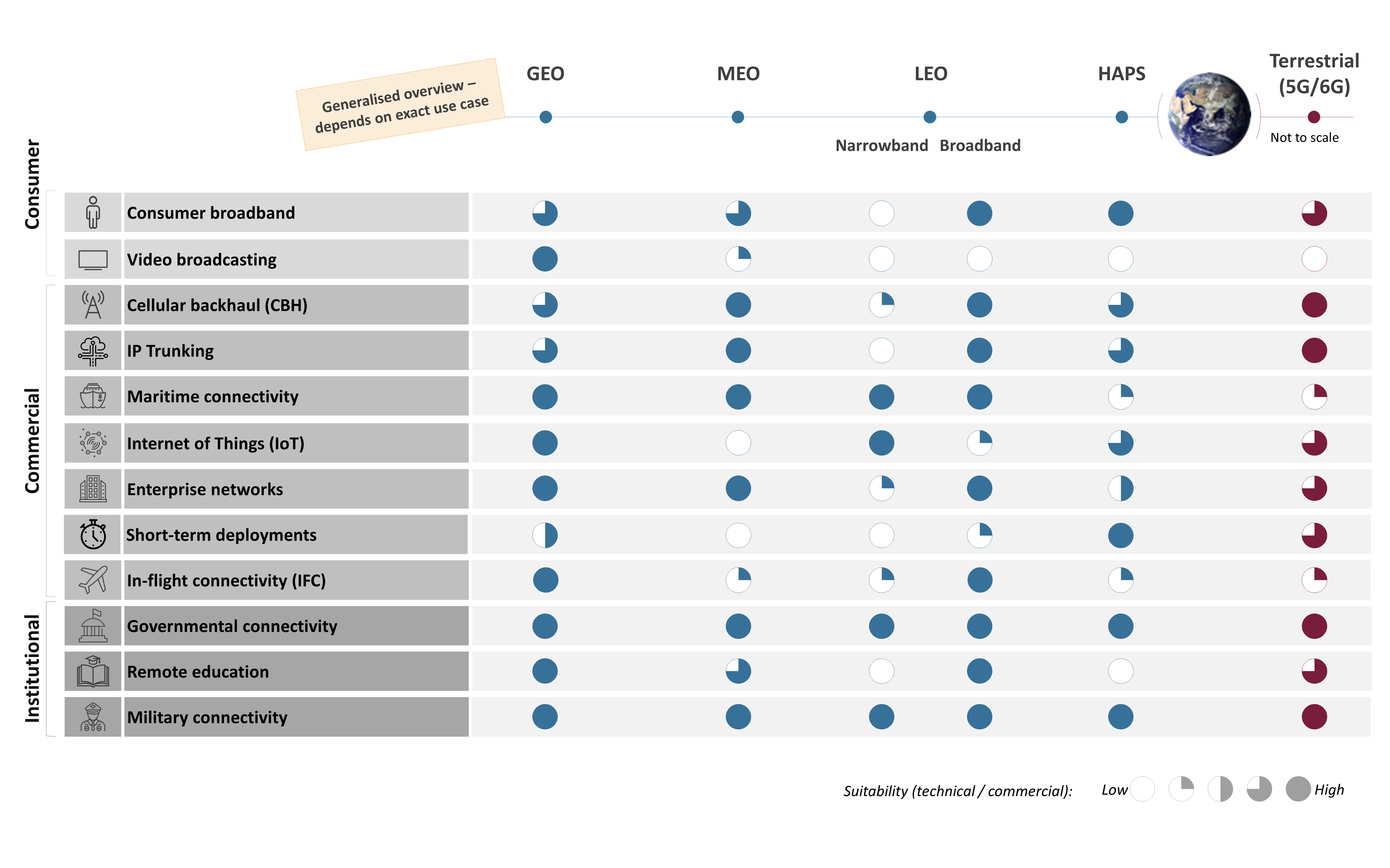

As part of the approach for integration, connectivity providers need to consider the different technologies in relation to key use cases. While nowadays all satellite orbits can facilitate high bandwidth networks, Geostationary (GEO) satellites have high bandwidth but are limited by high signal latencies, which affects real-time applications like video calls or gaming. LEO or Medium Earth Orbit (MEO) satellites, or even stratospheric high-altitude pseudo satellites (HAPS), have lower latency but only provide regional coverage and need handover operations for global reach. Satellite numbers and associated constellation costs are thus vastly different if the same level of coverage is the goal.

Cable-based networks have higher capacity but may be costly or unsuitable to deploy in challenging geographies and for remote mobile applications, so non-cable / non-terrestrial technologies are needed.

New business models are enabled by SatCom/telco convergence but operators need to be ready

The convergence of satellite and terrestrial communications is creating new opportunities and challenges for the connectivity industry.

Technologies such as D2D or HAPS can enable connectivity for various scenarios and applications, such as maritime, the Internet of Things (IoT) and smart cities through seamless and automated handover between terrestrial wireless and satellite networks depending on the situation.

However, Satellite operators embracing multi-orbit and integrated satellite-terrestrial capabilities are chartering new territory and discovering challenges along the way. Novaspace can support the ecosystem with strategic analysis, technology roadmapping, market and service portfolio strategies and decision-making linked to various key topics:

- Buy or build: Operators need to consider their convergence strategies, either developing their own capabilities or pursuing mergers and acquisitions (M&A) to boost their network reach and abilities. Some M&A deals have passed internal and external scrutiny (e.g., Eutelsat and OneWeb or Viasat and Inmarsat), while others prefer ringfenced and specific partnerships (e.g., Intelsat with Eutelsat and OneWeb). NewSpace players like IoT / D2D constellations team up with telcos or Mobile Network Operators (MNOs) to offer a combined solution to their respective customers.

- Optimise flow: To integrate and deliver services across different networks, efficient orchestration is critical. The goals of automated network orchestration need to be clearly defined to identify the most suitable technical solution for implementation. Tech companies are contributing by developing protocols and network solutions like SD-WAN for automation and integration of connectivity. Yet, a clear market leader still has to emerge.

- Ensure flexibility: Devices and terminals must support different communication technologies. Multi-frequency and multi-band antennas, steerable beams, flat-panel technologies and smaller, mass-produced components will be crucial for integrated communications solutions.

- Use spectrum efficiently: Regulators are increasingly focusing on the topic of telco / SatCom convergence. Strategic decisions regarding spectrum utilisation must be made to optimise network performance and minimise technical, administrative and regulatory obstacles. Optical communications may well be a crucial part of future strategies, enabling operators to navigate radio frequency spectrum challenges.

- Integrate technologies: Interoperability and adherence to standards (such as 3GPP) while integrating with terrestrial networks are also essential. To ensure fully integrated solutions, key insights need to be consolidated and processes harmonised with regards to technology, service delivery and customer expectations from the telco and the SatCom side.

- Set competitive service portfolios and pricing: Operators must adapt their service portfolio and pricing strategies to cater to the evolving demands of the market while remaining competitive in the face of increasing convergence. Successful pricing must include considerations around current markets and future market evolution, knowledge of the overall ecosystem, key competitor insights, detailed internal analysis of target markets, geographies and cost of service delivery.

In conclusion, the convergence of satellite and terrestrial communications is reshaping the global markets for telecommunications. Satellite operators need to address key strategic questions to move beyond individual orbits as silos and embrace integrated solutions that cater to the demands of modern users. If implemented successfully, the integration of multi-orbit satellite and terrestrial networks not only ensures seamless service delivery but also provides the foundation for the next generation of communication capabilities, fostering a truly connected world.

For any questions, please feel free to reach out via our contact form below.

[1] Source: Morgan Stanley